Basics of confluence trading

Trading the global market is sometimes considered an art rather than a scientific approach because it requires experience and knowledge to achieve results. To grow your trading experience, there is a need for you to have an edge that puts you in a vantage position to make a profit and have a more profitable streak. Trading with confluence is a strategy that ensures that you increase your return on investment as much as you need to succeed in the turbulent environment of the global market.

What is confluence trading?

In simple terms, confluence trading combines more than one trading strategy or analysis to increase your chances of making more profit. In other words, several trading strategies will be needed for a trader to verify the authenticity of the potential market opportunities.

You can think of this as a combination of different trading methods, where one technique is aimed at validating the other for you to make a perfect trade decision. This is how we come about the term “confluence” trading, similar to the point where two rivers come together.

How does confluence trading work?

To explain how confluence trading works, we must draw your attention to a live scenario. Take, for example, a trader who spots a potential zone for price reversal based on a support and resistance level. However, before opening a market position, the trader checks the Relative Strength Index (RSI) or Moving Average (MA) indicators to validate the potential price reversal.

In this scenario, the combination of a technical indicator may suggest a favorable decision or inform the trader to hold back. The middle point of the RSI is over 50, which indicates a bullish momentum. On the other hand, when it goes below 50, it suggests a bearish trend.

Live example:

Let us look at another similar example of how confluence trading works. Let’s say that a trader merges fundamental and technical strategies to trade the GBP/USD currency pair. He makes use of both methods to validate entry points. News is published about Fed’s decision which increases the US dollar to change the sentiment existing in the global market. Both the fundamental and technical analyses here work in tandem to provide safe entry and exit points on the price chart.

How do I find confluence when trading?

Trading confluence may seem attractive, but knowledge of how to apply it is far more critical. How do you leverage this trading strategy to achieve better results? We will talk about some practical ways you can trade with confluence by identifying it on the price chart. You can identify a confluence on the price chart in several ways, but we will be looking at the top three ways to do that.

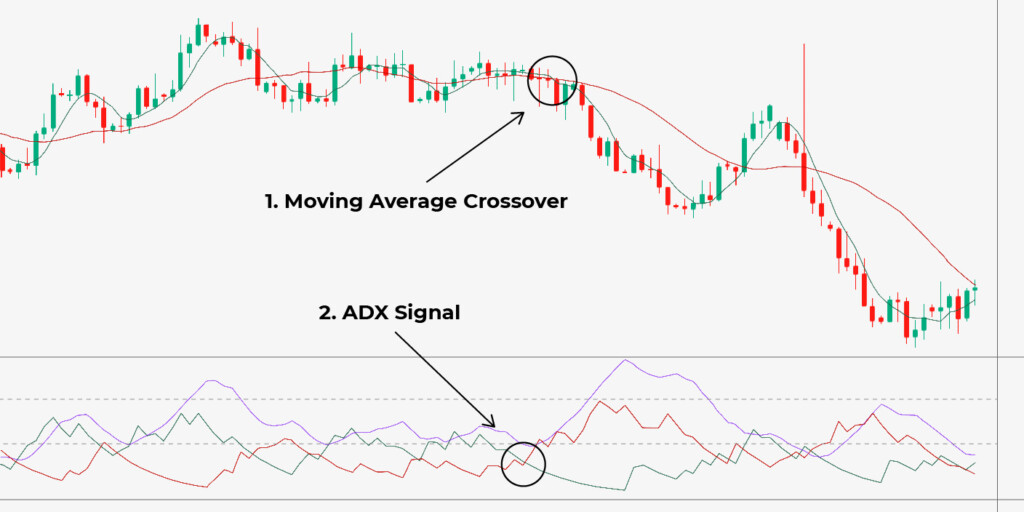

1. Utilizing technical indicators and bolts

One of the easiest ways to spot a confluence when trading is by adding a technical indicator to the trading process. When you combine two indicators, which give a similar trading signal, you will be able to determine whether or not to enter a trade. This will increase your chances of making profitable trading decisions and is also an excellent way to filter out fake trading signals.

Looking at the chart below, you will notice the combination of Stochastic and the MACD indicator. As you can observe in the chart, both indicators validate each other and point to the possibility of a price reversal in the price action.

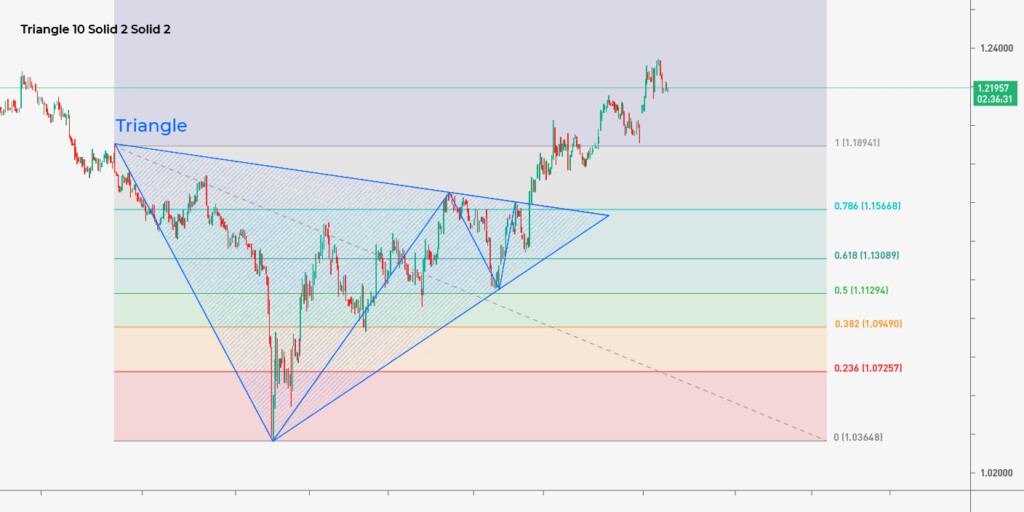

2. Using fibonacci retracement levels and chart patterns

You must have heard about extension and Fibonacci retracement levels as a trader. When planning to join a trend, these levels are often used to find pullbacks/corrections or trend reversals in the market. These can also be used to identify levels on the price chart where reversal is possible.

The Fibonacci retracement levels can be combined with price patterns for a more desirable result. Chart patterns are lines and shapes that are formed consistently on the chart. They help the trader to predict the movement of a security’s price in situations of a reversal or breakout. By combining this with the Fibonacci levels, traders can fine-tune their exit and entry strategy, making it a suitable trading method.

The chart above shows a butterfly pattern in addition to a Fibonacci retracement. You can see how they both predict the reversal in market price.

3. Confluence trading with technical and fundamental analysis

There remains a continuous debate among traders concerning analyzing the market. Some say fundamental analysis is significant, while others believe technical analysis remains prominent. Most successful traders believe that confluence trading combines both methods and is the best way to go.

While many fundamental traders focus on long-term trading, they are also likely to get authentic by focusing on trade analysis. In this situation, adding the technical analysis toolset can help to ease the condition. For example, if the price of an asset drops below the moving average and maintains a downward trend, one may begin to open another trade, to ensure better profit.

In market situations like this, the fundamental analysis confirms whatever technical signal you have, indicating a potential rally or downtrend. In other cases where the fundamental analysis contradicts technical analysis, it is suggestive that there is a false signal.

Pros of confluence trading

You will discover that trading confluence has a handful of benefits to your overall experience in the global market. This section will focus on the advantages of trading with multiple strategies.

Here are some of the benefits of trading confluence as a first-year trader:

—Better trading conviction

—It improves adaptivity

—Confluence trading makes room for backtesting your strategies

—There’s time to review your decision before entering the market.

Why do some traders fail with trading confluence?

We have established that trading confluence is a way of applying different strategies to achieve a profitable trade. However, some traders could do better, even with the availability of other trading options. Why is this so? Here, we will carefully examine why some traders fail at confluence trading.

1. Greed

Greed is the leading cause of unfortunate trading experiences while using the confluence trading method. Wanting to acquire as much profit from a single trade without carefully analyzing how to achieve that progress can be disastrous to one’s trading career.

2. Impatience

One thing you may not often hear about confluence trading is that it takes patience to master. For a trader to be effective with strategy combination, time is a vital part of such effectiveness.

3. Wrong confluence

Could there be any such thing as a wrong confluence? If it implies that a trader can wrongly combine two or more contrasting methods, then this is another factor to consider as to why some fail.

Conclusion

Trading confluence makes it easy to spot trading signals that are beneficial to your style. Traders can become well-established in one strategy, but learning to combine other strategies is a good way to confirm your plan and then make adjustments to whatever needs to be changed. Pro traders often trade confluence in situations where the market exhibits complex behavior. By merging two or more trading indicators, it becomes easier for traders to make accurate trading decisions.

Sources:

1. How To Trade: Confluence Trading – How to Use It to Improve Your Trading Performance

2. Forex training group: The Power Of Trading Confluence In The Foreign Exchange Market

3. Earn Forex: The Power of Confluence in the Forex Market

4. BabyPips: Confluent definition